This question makes as much sense as “Do you prefer red or apples?”. You’re comparing an adjective to a noun. You could have one, both, or neither. I’m going to demystify these common financial terms once and for all.

There are many ways to save for your retirement, and you should take advantage of all of them. Unfortunately, most of us don’t bother learning the different types of accounts available to do so because the concepts “retirement” and “investing” are about as interesting to a 20-year-old as “brussel sprouts”. Early in your career is the best time to start preparing, though, because that’s when compound interest has the longest amount of time to grow.

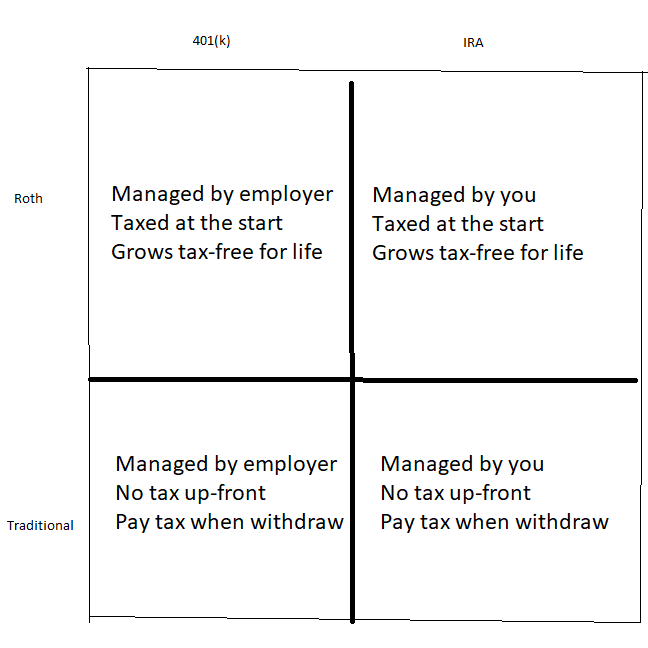

The first distinction we’ll learn about is by whom the account is managed. Most employers offer what’s called a “401(k) plan”. You’ve probably heard of it, and there’s a good chance your employer automatically enrolled you. Typically, these plans will have a pre-selected list of options you can choose from in order to keep things simple. This is your money, not your employer’s, meaning you can take it with you if you leave the company. Don’t be fooled by the fact that it’s “managed by your employer” – you get to choose what to invest in from that pre-selected list, and you choose how much you want to contribute from each paycheck. The current limit for your contributions to a 401(k) is $19,500 per year.

The other place you can find an account is managed by yourself – you, an individual. This is called an Individual Retirement Account, or IRA. You can open this at any brokerage of your choice – Vanguard, Fidelity, or my personal preference, a robo-advisor like Wealthfront or Betterment. You may have often heard this type of account colloquially referred to as a “Roth”, but if you learn anything from this post, please eliminate that usage from your vocabulary. We’ll learn why in a second. You’ll need to transfer money directly to this account – it won’t come out of your paycheck like the 401(k) does. The current limit for your contributions to an IRA is $6,000 per year.

Contrary to popular belief, this is not an either/or situation. You can have both a 401(k) account and an IRA. There are separate limits to each of them, as well. You don’t need to worry about them affecting each other in any way.

Why would anyone want one of these accounts? I’d rather have my money now, not wait until I’m 55 years old! The key is that each of these accounts allows you to avoid paying taxes in some way, meaning that you ultimately end up with more money in your pocket.

The second distinction we’ll learn about is what sort of tax advantages an account can provide. Both a 401(k) and an IRA have two “flavors”: Traditional or Roth. Traditional is also referred to as “pre-tax”, while Roth is sometimes referred to as “post-tax”. In a Traditional/Pre-Tax account, the money you put into it isn’t taxed in the year you receive it. If you earned $100,000 and put $10,000 into a Traditional account, the government would only tax you as if you earned $90,000. That money is then invested and grows tax-free until you withdraw it at retirement, at which point you finally pay taxes on it, hopefully at a lower rate because your income is lower. A Roth account is the other way around. You still pay the taxes now, but that means you never have to worry about any taxes on that money or any of the earnings on the investments. If you earned $100,000 and put $10,000 into a Roth account, the government would still tax you as if you earned $100,000 this year. But you’ll now have $10,000 of investments that can grow for 30 years with compound interest, and then you can withdraw it and not pay any taxes.

Ideally, you want to max out both of these accounts every year if you can afford to do so. The choice between Traditional vs Roth doesn’t matter nearly as much as the choice to save money for the future. Don’t wait, do it today!